How to Save for Retirement with Cryptocurrencies

Bitcoin is a digital asset that functions similarly to physical currency. Instead of using banks to back the funds, however, Bitcoin uses cryptography to manage its worth. Bitcoin’s popularity has also made it a popular IRA investment.

Bitcoin is a digital asset that functions similarly to physical currency. Instead of using banks to back the funds, however, Bitcoin uses cryptography to manage its worth. Bitcoin’s popularity has also made it a popular IRA investment.

We talked to Jamie Hopkins, Associate Professor at The American College of Financial Services, who told us that while digital currencies are here to stay, there are still a lot of unknowns when it comes to investing. Deciding to invest in Bitcoin for your IRA can be a risky but lucrative move. Our guide will help you find the right IRA company for your cryptocurrency investment.

Step 1: Open a Bitcoin IRA account

All digital IRAs, including IRAs for Bitcoin and other cryptocurrencies, are self-directed IRAS. This means that you are the only one who has a say in your investment decisions. There won’t be a third party involved who makes investment decisions for you. Your Bitcoin IRA will have a certified custodian who carries out your instructions for you. (This is a legal requirement to ensure your IRA follows all the rules and regulations outlined by the IRS.) The custodian acts as an account administrator and does not make investment decisions for you.

You can apply for your Bitcoin IRA online with your chosen company. Some companies, like Bitcoin IRA, allow you to opt for managed service, in which a live agent walks you through the application process.

Note: Even though Bitcoin is known for its anonymity, your Bitcoin IRA application will need to include some identifying information.

Step 2: Fund your Bitcoin IRA

Once your account has been set up, your Bitcoin IRA company will submit a request to transfer funds from your existing retirement account to the new Bitcoin IRA. This is a fast process that can usually be completed in as little as five minutes.

Step 3: Buy Bitcoin

The company you work with should schedule time with you to buy Bitcoin to add to your IRA. The IRS currently does not allow investors to roll Bitcoins they already own into a new Bitcoin IRA.

Step 4: Setup a Bitcoin wallet

Your Bitcoin IRA company will generally handle the setup and security of your Bitcoin wallet for you. Many Bitcoin IRA companies use cold storage, which means your Bitcoin is stored offline. Other companies partner with companies like BitGo who manage secure wallets.

Now it’s time to pick a cryptocurrency to invest in. Common options include Bitcoin, Litecoin, Ethereum, and Ripple.

Bitcoin (BTC)

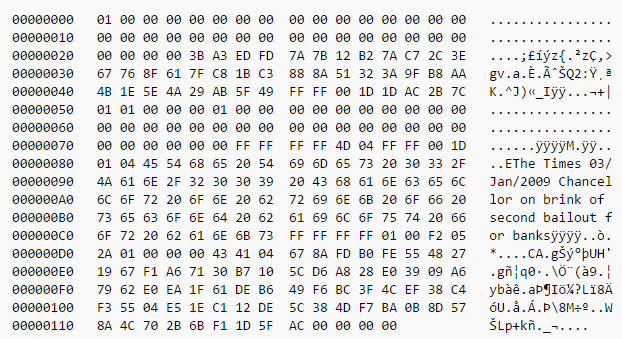

Bitcoin is the first and most famous cryptocurrency. It was invented in 2009 as a peer-to-peer electronic cash system and is capped at 21 million coins. If you’re rolling your cryptocurrency into an IRA, you’ll likely be investing in Bitcoin. However, some IRA companies can help you find other options. Bitcoin’s platform allows for up to seven transactions per second.

Litecoin (LTC)

Litecoin is another cryptocurrency that functions quite similarly to Bitcoin. Litecoin launched in 2011, and it generally has a faster transaction than Bitcoin at 56 transactions per second. A Litecoin IRA is cheaper than Bitcoin, minimizing both your risk and your potential reward. Litecoin is capped at 84 million coins, which is significantly more than Bitcoin’s cap of 21 million. It also has a smaller price per unit. You can invest in Litecoin with companies like Noble Bitcoin and Bitcoin IRA.

Ethereum (ETH)

Ethereum is a software platform that enables contracts to work without any downtime. It produces a token called “ether,” which is used as a sort of currency on its platform. Ethereum’s technology is specifically aimed at smart contracts, which are written in code into a blockchain. Ethereum has a maximum processing time of 20 transactions per second. You can invest in the Ethereum platform with your IRA if you choose a company like Bitcoin IRA or Noble Bitcoin.

Ripple (XRP)

Ripple is a global settlement network that was built for enterprises. It is primarily used by banks and payment providers. Ripple offers low-risk intercontinental payments at low costs with full transparency. Unlike Bitcoin, Ripple currency does not have to be mined, and since it is not as widely-known as Bitcoin, it’s often a cheaper investment for an IRA. It has a significantly faster transaction processing time than other cryptocurrencies at 1,500 transactions per second and an average transaction time of four seconds. Noble Bitcoin and Bitcoin IRA are great options if you’re looking to invest in Ripple.

Check out ConsumerAffairs Bitcoin IRA Companies guide for more information.