Virtex.com: A Lithuanian Exchange with Global Aspirations

By Mark Norton 7/30/2014

The end of 2013 and the beginning of 2014 was a brutal time for Bitcoin businesses: BitInstant, BitFloor, Coinlenders and Input.io, Silkroad, Neo and Bee, and finally, the massive crash of Mt. Gox. For a little while it seemed as though a week didn’t pass without headline news (both in and out of the Bitcoin specialty press) of a major hack, theft, or indictment. The mainstream press reveled in the abundant proof that Bitcoin was a passing fad and reported numerous times on the death of Bitcoin.

And yet … we’re still here and Bitcoin is trading at multiples of what it was this time last year. Further, the dramatic failures have slowed to a trickle as those companies and  people who could not really handle the challenges of running a Bitcoin business were winnowed out. At the same time, numerous people and groups are busy building the infrastructure, both of Bitcoin the currency and Bitcoin 2.0 that will be the foundation of widespread adoption.

people who could not really handle the challenges of running a Bitcoin business were winnowed out. At the same time, numerous people and groups are busy building the infrastructure, both of Bitcoin the currency and Bitcoin 2.0 that will be the foundation of widespread adoption.

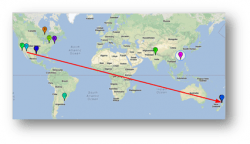

One such group of people are Paulius Meskauskas, Tomas Andzelis, and Mantas Gustys who form the heart of a new Bitcoin exchange located in Lithuania, but with global aspirations. I got in contact with Mantas, the Chief Relations Officer of Virtex.com to ask as few questions about this fledgling company.

Thanks, Mantas, for taking the time to talk with me. First I’d like to now a little about how Bitcoin is doing in Lithuania. A recent CoinDesk article reports that just one percent of the population is using Bitcoin and that the country ranks 46th for Bitcoin usage in the world. What do people think of it on the street?

Well the problem with Bitcoin in Lithuania is that most of the people haven’t even heard about it, especially the elder ones. And those people that have heard of it mainly picked it up from online news. Now most of the people out there know what the mainstream media tends to do – they pick a side that is more favorable to them (for whatever reason – political bias, ratings, etc.) and then they excessively elaborate on it. In our case they picked the negative side. Even though Bitcoin (and cryptocurrencies in general) is not a very hot topic, a new article regarding its “dangers” can be caught every now and then. Naturally this creates a negative opinion towards the currency. I personally have had countless talks with my friends and relatives in an attempt to at least vaguely describe the basic concept of a decentralized online currency. And whilst most of the time these talks are met with skepticism, people change their minds once they start to understand the basics. Sadly, though, I believe that it will take quite some time for Bitcoin to catch on in Lithuania.

What do you think are the reasons Lithuanians would want to, or conversely not want to, use Bitcoins? What do you think is the best way to overcome that?

I believe the main reason why Lithuanians would want (or should want) to adopt Bitcoin is the independence that it provides. I am talking about independence from financial institutions of course. During the past few years there have been 2 major Lithuanian banks that went bankrupt. Obviously this led to a lot of mistrust towards the banking industry among Lithuanians. And while this does create a favorable environment for Bitcoin, the media has been effective in deterring the average Lithuanian from using it.

What’s the legal environment there? The central bank has issued a kind of ‘wait and see’ proclamation, but do you have any sense of how regulations for your exchange and for Bitcoin in Lithuania are going to develop?

The last statement that the central bank has issued actually discourages people from using Bitcoin. And while I would love Bitcoin to be embraced by the Lithuanian government, I can hardly see that happening. Just last year a story broke out about a businessman who had his bank account frozen without prior warning. Why do you ask? The bank found out that this businessman owned an online cryptocurrency exchange. And even though this specific account was not even used for any Bitcoin-related transfers, the man still had to answer a ton of questions about funding terrorist activities, money laundering, etc. This just goes to show that someone high up in the financial system really does not want competition coming in  to the market.

to the market.

What do you think that Bitcoin can do for Lithuanian society?

The same that it could do to any society: Bring people closer together and liberate them from the current financial system which does not serve the people. Currently Bitcoin stands as our best chance to take back control of our money, so we should make the best of it.

Who do you see as your primary target? You are located in Lithuania, but say that you have a worldwide target and are putting a site up in English. What’s the vision for your company?

We aim for a very broad audience, which ranges from newbies who do not know much about cryptocurrencies (hence the education section + informative blog posts) to professionals who have been in the business for quite some time (this is not yet so obvious, but we are working on a lot of site improvements for the advanced trader). We envision Virtex as an exchange that will one day set the industry standard as a trusted, professional and friendly exchange.

The market for exchanges seems very complex and risky. You folks opened your doors in late April, not long after the fall of MtGox. What made you want to start an exchange and what makes you stand out from the pack?

When we first heard about the idea of a decentralized currency which enables people to act as their own banks, we were overwhelmed. We simply could not believe it when we first discovered it. Seeing how this wonderful new idea of digital money could reshape the world we live in, our team decided that we wanted to do more than just watch the revolution happen. We wanted to be a part of it. That is when I, Tomas and Paulius decided to open a cryptocurrency exchange, which would allow people from all over the world to acquire and sell Bitcoins.

We aimed for an exchange which was secure, transparent, intuitive and simple, and also professional at the same time. And we believe those points have been achieved so far. But of course this does not mean that we are going to stop here; there are a lot of improvements on our schedule. Also, seeing how some exchanges have very limited funding options we wanted to be the exchange which had the most “ins and outs.” Currently we already have 4 payment gateways added to our exchange and there are going to be a lot more (we plan on adding around 1 new gateway every couple of weeks). Bank wires are planned to be implemented tomorrow. In conclusion I would like to say that the exchange that you currently see may be compared to a young eagle, which is only beginning to spread its wings. Soon we will begin our flight.

What’s the reason for choosing the name Virtex when there is already an established exchange with that name operating?

We simply felt it described our business best. It is short, memorable and pleasant to the ear. On top of that, the domain was available and the name was not trademarked. After considering, it we felt that the distinction between the two exchanges would be established quite soon after launch when people see that we have nothing in common. Of course we weighed the fact that there will be some negativity from the community towards it, which was why we set up our operations in a way that would let us evade a clash with the other exchange altogether.

MtGox and, of course, a lot of other Bitcoin businesses were done in through poor security and amateurish management. Many bitconers are calling for external, independent audits and open books to prevent this kind of thing from happening again. Could you tell me specifically what you are doing to keep your investors’ money safe?

As transparency is one of our aims we will definitely call for regular external audits in the future to guarantee all of the funds are in place. For the time being we have all the top-level security features implemented which guarantee that our customers money is as safe as possible.

You have a number of payment partners, but of course the friction between Bitcoin and fiat is one of the things that is really holding it back. How easy or difficult are you finding it to receive and send fiat? Have you had any issues with banks?

Due to the general negativity towards Bitcoin in the Lithuanian banking system we decided that it would be best to avoid Lithuanian banks altogether. By outsourcing our financial operations we were able to operate peacefully without any issued so far.

Your page describing AML and KYC policies might be concerning to some bitcoiners: They have to send documentation to show who they are and then you state you’ll be watching trades for ‘suspicious’ activity. What counts as suspicious activity and how can a potential investor be sure they will not have their funds frozen? What recourse do they have if that does happen?

We can assure you that if you are not trying to hack or break our system in any way, your account will not get frozen; however, if by any chance a user’s account does get frozen and he/she believes it was done by mistake, they would need to submit a ticket via our support system so we could look into the issue deeper.

How do you feel the new BitLicense proposal out of New York will affect your operation?

Hopefully it will not affect us much. We currently do not serve customers from the United States and this sort of legislation lets me think that we will not start serving them any time soon. In my opinion, the BitLicense proposal undermines the fundamental advantages of Bitcoin and I hope that the 45-day hearing period will bring in some needed changes before the final legislation is approved. I loved how Erik Voorhees summarized the BitLicense proposal: “Alas, what conclusion can be drawn from Lawsky’s proclamation other than the following: Bitcoin shall be tossed into the same unethical regulatory mess that currently governs the legacy banking system. It shall comply with the same mandates, be governed in the same way, by the same people. It shall be censored with the same prejudices, and serve as an Orwellian tool of law enforcement in the same corrupt and deleterious manner. Its protection of privacy, illegal. Its advocacy of neutrality, ignored. Its efficiencies, minimized. Its decentralized, market-based governance forced to revert to centralized, State-based coercion. Why? Because the men with guns say so and the men with the businesses don’t really want to make a fuss about it.”

You folks are apparently incorporated in the Seychelles. Companies incorporated in island paradises far from the actual headquarters of the business may give people a reason to worry. I commend you for revealing it on your site, but what are the advantages of doing this?

One word – transparency. We simply do not want to hide these kind of things from our customers. We believe that the more open we are, the better. I would personally want to know as much as I can about an exchange before I trust my money to it, wouldn’t you?

What’s your 30 second elevator pitch for Bitcoin?

Bitcoin is a revolutionary new medium of wealth transfer which eradicates the need of a costly third party service i.e. a bank. The service is cheap, anonymous and fast! There are no application forms, no lines, no waiting time, the service is global, it’s available 24/7 and you can be sure that your transfer will never be canceled or frozen by anyone else. It is protected from inflation by a limited supply and coded in a way that prevents it from being counterfeited. By setting up a Bitcoin wallet you become your own bank. No one else has access to your funds and only you decide how to use them. Bitcoin is not owned by anyone but the people. It’s time to move on from the rusty old banking system. It’s time to reclaim the ownership of our money. It’s time to start using Bitcoin.

Correction: The original version of this article mistakenly reported Mantas’ position as Chief Risk Officer instead of Chief Relations Officer.

Thanks to Mantas Gustys for taking the time to answer my questions. If you are interested, please visit them here.